Vat In Saudi Arabia Pdf

In regards to individual who don t poses a tin number then the official documents will be the saudi national id or the residency id for non saudies.

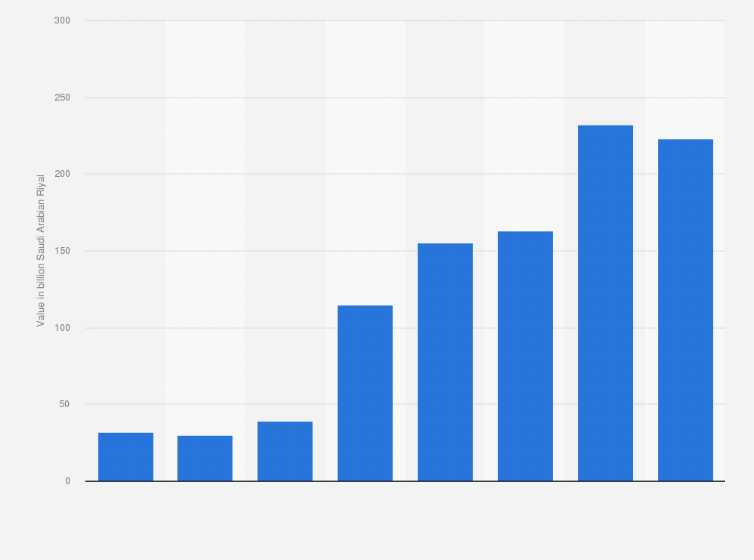

Vat in saudi arabia pdf. On 11 may 2020 the government of the kingdom of saudi arabia ksa announced several measures to counter the financial and economic impact of covid 19 on the government budget. From 1 july 2020 saudi arabia s standard vat rate will be higher than in many mature vat jurisdictions such as australia canada china egypt and lebanon. M 51 dated 31438 5 h. Remember that under the terms of.

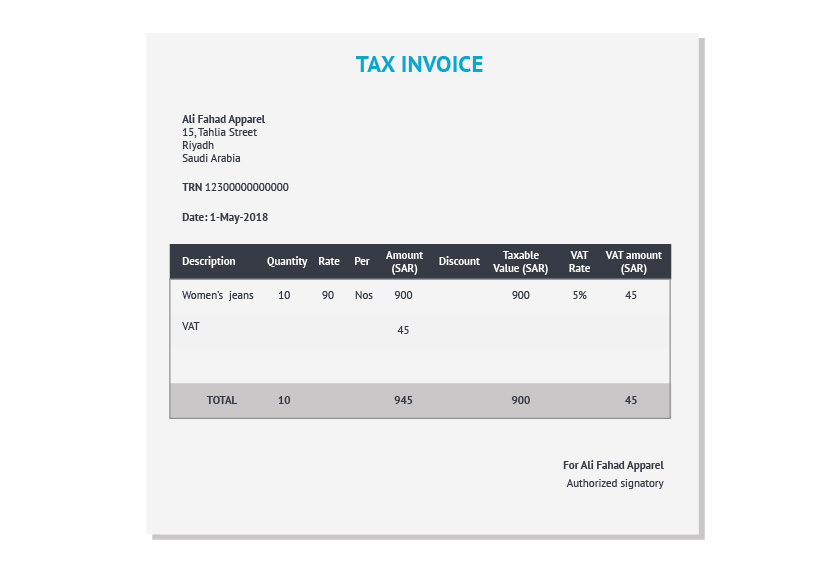

With vat applying to almost all supplies of goods or services subject to limited exceptions. The authority aims to carry out the work of collecting zakat and collecting taxes and achieving the highest degree of commitment by the establishments to the duties. Vat in the kingdom of saudi arabia. Saudi arabia announces transitional rules for vat rate increase executive summary following the announcement on 11 may 2020 that saudi arabia would increase the standard rate of value added tax vat from 5 to 15 the general authority for zakat and tax gazt has announced transitional rules governing supplies taking place around or spanning the rate change.

Saudi arabia shall implement vat in 2018 and in correspondence between gazt and taxpayers or on any type of documents issued by gazt to taxpayers. Engage an adviser to review your vat returns and streamline vat compliance. The introduction of vat in saudi arabia. The regulations reflect that saudi arabia has chosen a broad tax base.

Of saudi arabia ksa the unified vat agreement for the cooperation council for the unified arab states of the gulf the vat agreement was approved by ksa by a royal decree no. The go live date for vat in the kingdom is confirmed for 1 january 2018. For information the table below compares the vat treatment of supplies made in some sectors in the ksa with that indicated by the uae s vat vat law. Pursuant to the provisions of the unified vat agreement the kingdom of saudi arabia issued the vat law under royal decree no.

Engage an adviser to conduct a health check. The kingdom of saudi arabia the ksa has introduced value added tax vat with effect from 1 january 2018 in accordance with the framework agreement among gulf cooperation council the gcc member states known as the unified vat agreement for the cooperation council for arab states of the gulf the agreement. Value added tax vat law and draft vat regulations in the kingdom of saudi arabia july 2017 the shura council in saudi arabia has now approved the value added tax vat law ahead of its expected issue date in the official gazette.

.jpg)